The Citi PremierMiles Card is my first ever credit card. I applied for it as soon as I started working in 2009 and I’ve been holding it for over 10 years. Citi probably should give me a loyalty reward after all these years, no?

Anyway, if you’ve come to this article, you’re probably considering whether the Citi PremierMiles card is worth it. As someone who’s been using Citi for over a decade, I figured it’s time for me to write an honest review about Citi PremierMiles card. So, here it is.

Table of Contents

What is Citi PremierMiles Card?

Citi PremierMiles card is a credit card that rewards users with Citi miles when they spend using the card. The Citi miles never expire and can be transferred to various airline partners. In short, it’s a card for miles chasers.

Benefits of Citi PremierMiles Card

Benefit #1: Lounge Access

PremierMiles card holders are entitled to 2 complimentary visits to airport lounges worldwide (via the Priority Pass network) per calendar year.

To enjoy the free airport lounge access, you need to register for Priority Pass. Here’s the step-by-step procedures. Upon successful registration, you’ll have a digital membership card in your Priority Pass mobile app. When you visit a lounge, simply present your PP digital membership card in the app together with your Citi PremierMiles card, as well as your boarding pass.

Do note that the free 2 visits entitlement is per calendar year. That means, it resets on 1 January every year, regardless of when you got your card. If you’ve used up your free 2 visits but you want to visit another lounge in PP network, your next visit will be charged at the prevailing rate (currently it’s USD 32 per person per visit).

Benefit #2: Miles never expire

There are not many cards in Singapore market that offers never-expired miles and one of them is the Citi PremierMiles card. This is a great feature for slow miles chases.

If your goal is to redeem a business class on an SIA flight from Singapore to Europe, you need to have 92,000 miles (miles amount is correct at the time of writing). If you only spend 1000 a month, you’re earning 1200 miles a month. To save up to 92,000 miles, you’ll need 76 months, which is about 6.5 years. With this feature, you can take your own sweet time saving up miles.

For me, I’ve been saving up miles since 2009 and I finally have 90,000 Citi miles in 2021. That’s 12 years worth of saving!

Benefit #3: Local Spend = 1.2 mpd, Overseas Spend = 2 mpd, Bonus Spend = varies

You will earn 1.2 miles per dollar for local spending, and 2 miles per dollar when you spend in foreign currency.

For example:

- If you spend SGD 100, you will earn 120 Citi Miles

- If you spend USD 100 (equivalent to 130 SGD), you will earn 260 Citi Miles

Do note that if you spend in foreign currency using Citi PremierMiles, you’ll be subjected to 3.25% admin fee. So, the miles earning power per dollar is actually 4/(2*1.0325) = 1.937 miles per dollar.

Benefit #4: Travel Insurance

If you charge your travel tickets to your Citi PremierMiles card, you’ll get up to S$1,000,000 coverage in the event of death or permanent disablement, arising from an accident in a common carrier; up to S$40,000 medical benefits; up to S$1,000 travel inconveniences. For full set of policy terms and exclusions, you can click here.

Sign Up Bonus via Citibank

From now until 31 Jan 2024, there are 2 sign-up bonuses you can choose when you sign up for Citi PremierMiles Card via Citibank website: 8,000 Citi Miles OR 30,000 Citi Miles.

To get 8,000 Citi Miles, you need to:

- Spend S$800 within 2 full calendar months after the end of that first month of card approval (T&C)

To get 30,000 Citi Miles, you need to:

- Spend S$800 within 2 full calendar months after the end of that first month of card approval (T&C)

- Pay annual fee for the first year, which will be charged in the first month upon approval

This promotion is valid for new customers (someone who has never hold Citibank in the past 12 months before application). Do note that if you sign up under Citibank promotion, you won’t be entitled to the below SingSaver’s sign up bonus.

Sign Up Bonus via SingSaver

New-to-bank customers who sign up from now until 30 Sep 2024 will receive an Apple iPad 9th Gen 10.9 wifi 64GB (worth S$508.30), or Dyson Airwrap (worth S$859), or Samsonite Straren Spinner 67/24 + 2X AirTag (worth S$690.80), or 21K Max Miles or S$450 Shopee Vouchers upon activating and spending (min. S$500 spend) within 30 days of card approval.

Here’s the procedure:

- Step 1: Apply by clicking the link above

- Step 2: You will be taken to SingSaver website. Input your email and click “Confirm”

- Step 3: You will receive email from SingSaver with a link to get to redemption form. Keep the email for now.

- Step 4: Go to the Citi PremierMiles website and apply for the credit card. After completing the application, you will receive the Application Reference Number (ARN). Keep a copy of this confirmation.

- Step 5: Open the email that you received from SingSaver in Step 3, click on the link to go to Rewards Redemption Form. Fill up the redemption form with your ARN number and your choice of gift. This part is crucial, and you must fill up the form, otherwise you won’t be entitled to the gift.

- Step 6: Spend at least $500 qualifying spend on your card and wait for SingSaver to fulfil your gift (you will receive email on collection of gift about 60 to 120 days from the date of submission of the Rewards Redemption Form or from the date of their product approval, whichever is later).

Successful applicants must ensure that their credit card is valid and in good standing (not cancelled or blocked) at the point of gift fulfilment, and must retain and not cancel it for a period of 12 months from the date of approval.

If you’re already a Citi existing cardmembers, you will not be eligible for the above bonuses. Do note that if you sign up under SingSaver promotion, you won’t be entitled to Citibank’s 8,000 or 30,000 miles promotion.

Requirement

Here are the requirements:

- Age: 21 or older

- Min. income: S$30,000 (Singaporean/PR) or S$42,000 (Foreigner) a year

- Documents required for Salaried employee:

- A copy of your NRIC/passport

- Latest original computerized payslip or Tax Notice of Assessment or last 12 months’ CPF statements

- Documents required for Self-employed:

- A copy of your NRIC/passport

- Last 2 years’ Income Tax Notice of Assessment

- Last 3 months’ bank statements

Annual Fee

Annual fee is S$180 + GST. After adding 8% GST, it’s S$194.40. After paying the annual fee, you’ll get renewal bonus of 10,000 Citi miles (equivalent to buying miles at 1.93 cents each mile)

If you don’t want to pay annual fee, you can request for annual fee waiver simply by calling in.

If you ask me whether it’s worth paying annual fee to get the renewal bonus of 10,000, it depends on how aggressive you are when chasing miles. If you are in a rush to earn certain miles by certain date, then it’s definitely worth paying for annual fee. Otherwise, you can just take your own time earning miles from spending, not from paying annual fee.

Which spending should I use Citi PremierMiles

If you’re chasing the welcome bonus miles, then you want to use Citi PremierMiles for ALL of your spending.

If you’re not chasing welcome bonus miles, because of its (quite low) miles earning rate, I would recommend using Citi PremierMiles for general spending, including spending that can’t earn higher miles elsewhere, and spending where you get huge discounts using Citi cards.

Personally, I like to use Citi PremierMiles for overseas spending, healthcare institutions, when I can get huge discounts for using Citi card, as well as when I want to make big purchase with installment and Citi allows 0% interest.

I don’t use Citi PremierMiles for insurance, telcos, utilities, topping up prepaid accounts because these transactions don’t earn miles.

How to maximise miles earning with Citi PremierMiles

Here are ways to earn more miles beyond the 1.2mpd local spending / 2mpd overseas spending.

Bonus spend

- Earn 10 Citi Miles per S$1 spent on kaligo.com/bonus-miles (T&C apply)

- Earn up to 7 Citi Miles per S$1 spent on www.agoda.com/bonusmiles (T&C apply)

Pro-tip regarding bonus spend: do compare prices at other websites before making a booking and decide whether it’s worth booking through Kaligo or Agoda.

Citi PayAll

If you need to make payment where credit card payment is not accepted (such as rent, education expenses, taxes, condominium management fees, electricity bills, insurance premiums), then you can use Citi PayAll. Your recipients don’t need to have Citi account; you just need to have their local bank accounts.

By using Citi PayAll, you’ll be charged a certain amount of fee (which will be shown to you after you input recipient details and transaction amount). From my own experience, the fee is typically 2%.

You’ll then earn miles that you’d otherwise not earned because these vendors don’t accept credit card. The miles earning rate is 1.2mpd of the payment amount. Fees won’t earn any miles.

Pay Annual Fee

When you pay annual fee (S$180 + GST), you’ll get a renewal bonus of 10,000 miles.

Where to use the Miles from Citi PremierMiles

1. Transfer Citi Miles to Airline Partners

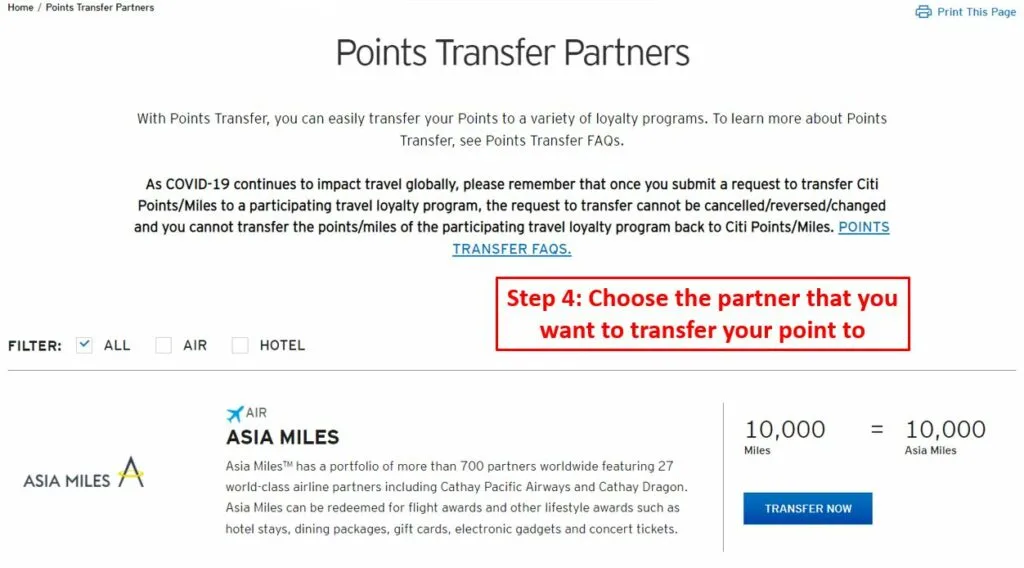

The rate is 10,000 Citi Miles to 10,000 airline partner miles. Minimum transfer is 10,000 per transaction. The fee is SGD 26.75 per transaction, regardless of how many points you transfer. Here are the airline programs that you can transfer your Citi Miles to:

- Singapore Airlines

- Asia Miles (Cathay Pacific)

- British Airways

- Etihad

- EVA Air

- Flying Blue (Air France & KLM)

- Malaysia Airlines

- Qantas

- Qatar Airways

- Thai Airways

- Turkish Airlines

2. Transfer Citi Miles to Hotel Partners

- IHG

The rate is 10,000 Citi Miles to 10,000 hotel partner miles. Minimum transfer is 10,000 per transaction. The fee is SGD 26.75 per transaction, regardless of how many points you transfer.

3. Citi Pay with Points

Sometimes, after completing certain transactions, you will get SMS from Citi telling you that you can pay for that transactions using Citi Miles by clicking some links. Or, Citi may tell you that you can pay for your annual fee using Citi Miles. My recommendation is DON’T DO THAT. The reason is because you’re getting less value through this method than through transfer to airline partners.

Citibank doesn’t publish the exchange rate for this Pay with Points feature, but from what I observe based on my own transaction, the value of a mile is equivalent to 0.6 cents. For comparison, if you transfer Citi Miles to airline partners and you use it to redeem a business class ticket, a mile is worth at least 1.5 cents per mile.

How to Redeem Citi Miles on Your Citi PremierMiles

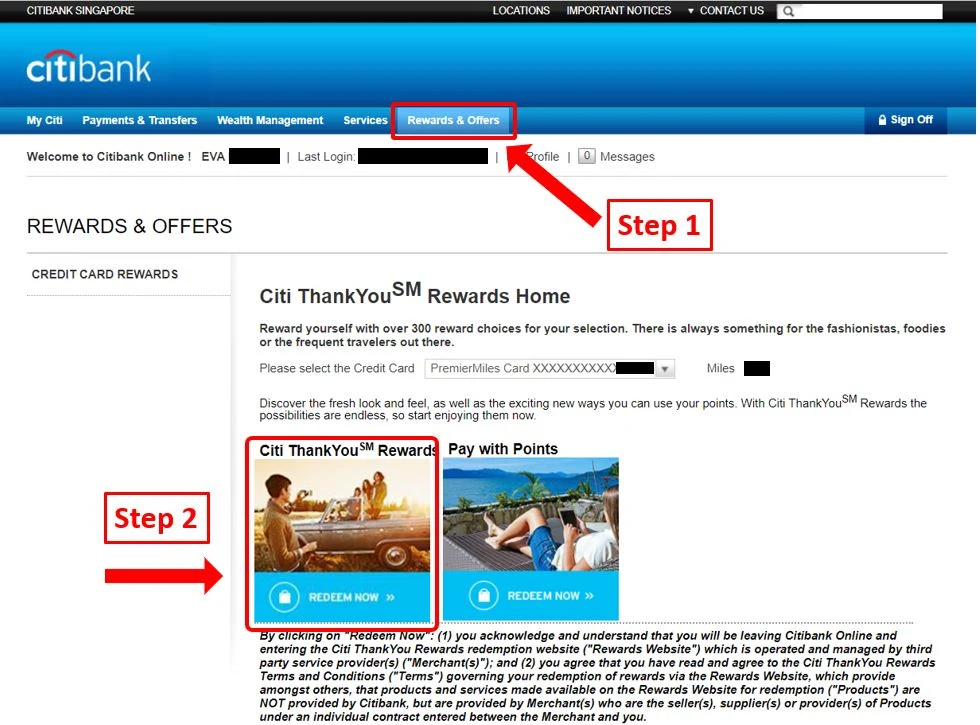

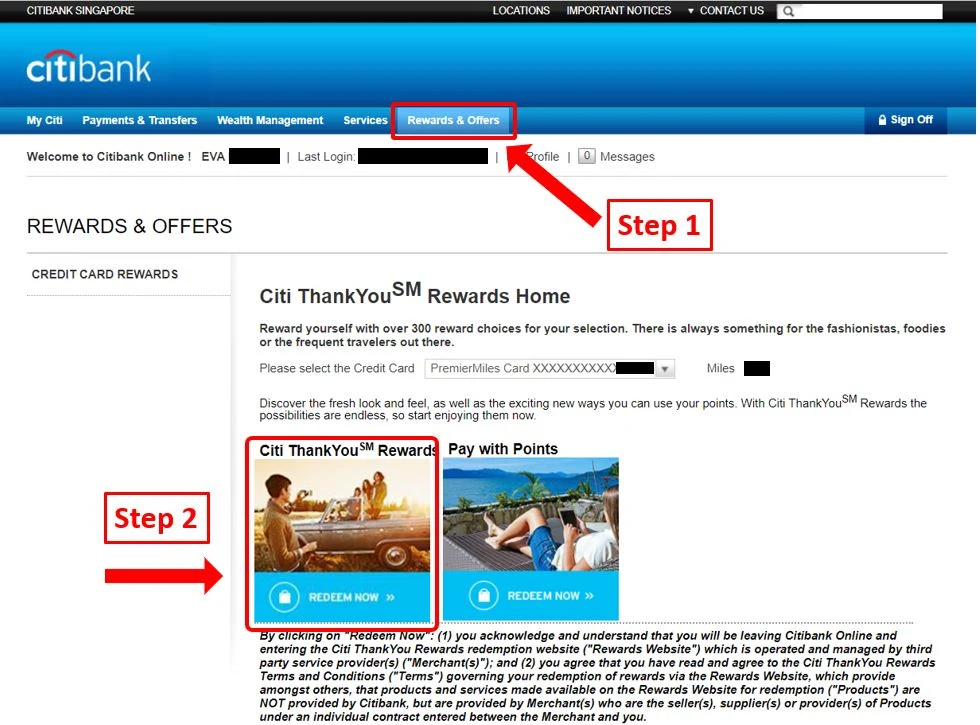

- Step 1: Login to your Citibank Online Banking. Click “Rewards & Offers” tab

- Step 2: Click Citi ThankYou Rewards

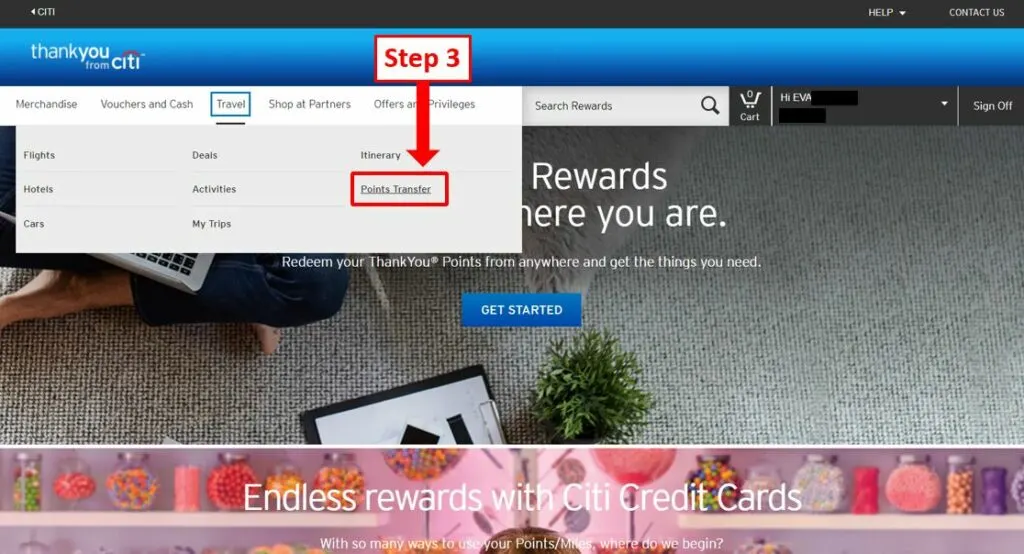

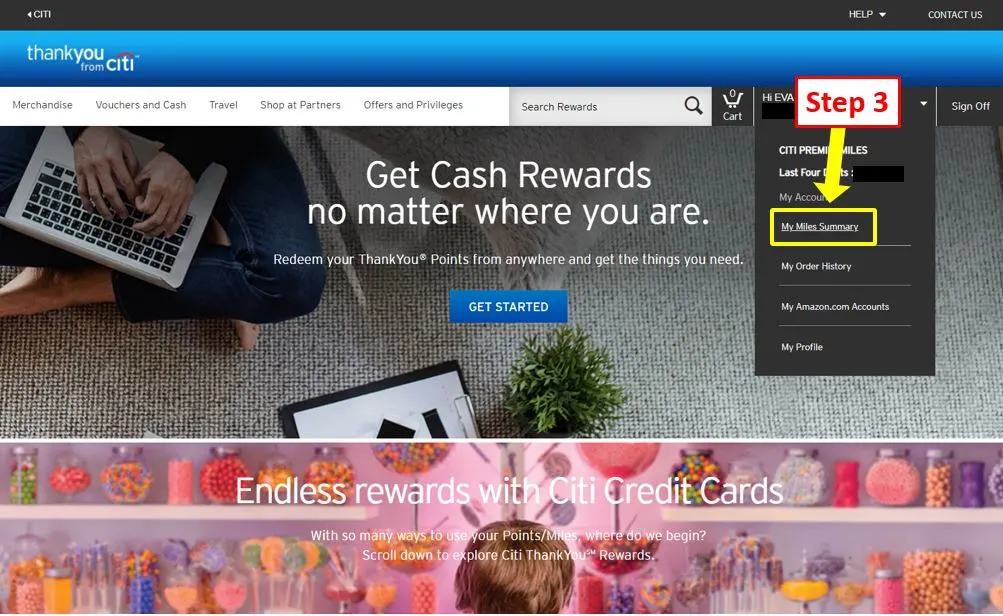

- Step 3: In the Citi Rewards page, click “Travel -> Points Transfer”

- Step 4: Choose the partner that you want to transfer your points to.

Citi PremierMiles vs DBS Altitude

I think it’s safe to say that Citi PremierMiles and DBS Altitude are direct competitors. Both offers the same benefits, namely free 2 lounge access via Priority Pass, never-expire miles, travel insurance and similar miles earning rate. The difference is in the details, and here they are.

| Citi PremierMiles | DBS Altitude | |

|---|---|---|

| Lounge Access | 2 visits per calendar year | 2 visits per membership year |

| Points Pooling across cards | No | Yes |

| Airline Transfer Partner | ▪ Singapore Airlines ▪ Asia Miles (Cathay Pacific) ▪ British Airways ▪ Etihad ▪ EVA Air ▪ Flying Blue (Air France & KLM) ▪ Malaysia Airlines ▪ Qantas ▪ Qatar Airways ▪ Thai Airways ▪ Turkish Airlines | ▪ Singapore Airlines ▪ Air Asia ▪ Cathay Pacific ▪ Qantas |

| Travel Insurance Coverage | ▪ up to 1,000,000 death/permanent disability ▪ up to 40,000 medical benefits ▪ up to 1,000 travel inconveniences benefits | ▪ up to 1,000,000 death/permanent disability ▪ no medical benefits ▪ no travel inconveniences benefits |

How much is a Citi Miles worth?

1 Citi Mile is worth 1 airline miles or 1 hotel miles.

Citi Miles earned from Citi PremierMiles Card do not pool with other Citi credit cards. That means, if you have 15,000 Citi Miles and 35,000 ThankYou Points from Citi Rewards Card, you have to redeem them separately and pay SGD25+GST for each redemption. Since the minimum redemption amount is 10,000 points and you can only redeem in the block of 10,000, in this scenario, you can only redeem 10,000 Citi Miles and 30,000 ThankYou Points.

Spending Exclusion

The following transaction will not earn Citi Miles:

- Quasi Cash / Financial Services

- Education Institutions

- Professional Services and Membership Organizations

- Government Services

- Insurance

- Public Transport

- Utilities

- Telco bills

Here’s the full list.

How to Check How Many Miles Earned in Each Transaction

- Step 1: Login to your Citibank Online Banking. Click “Rewards & Offers” tab

- Step 2: Click Citi ThankYou Rewards

- Step 3: In the Citi Rewards page, click the dropdown beside your name, and choose “My Miles Summary”

You will then be able to see the amount of miles earned on certain date. The system doesn’t breakdown the miles for each transaction, instead, it reports the miles based on the date the transaction is confirmed (which is roughly 2-4 days after a transaction is performed). It’s not perfect, but it’s better than nothing.

What I Love about Citi PremierMiles

- I love the 2 free lounge access each year regardless of whether I pay annual fee or not

- I love that Citi miles never expire, so I can take my own sweet time saving up miles

What I Don’t Like about Citi PremierMiles

- It’s quite a hassle to check the miles earned in each transaction

- Many spending categories are excluded (can’t earn points for utilities, telco, public transport, insurance, etc)

Conclusion

Citi PremierMiles Card is a great card for low spender because the miles never expire. It is also a great card to keep if you love to visit airport lounges when you travel.

Because they occasionally have miles purchase promotion or Citi PayAll promotion, it also makes a great card for aggressive miles chasers.

If you like my work, you can buy me a coffee! Your support will help me to keep going!

Supporter

Friday 19th of August 2022

Hi Eva, just wanna say your blog is very interesting and I enjoyed reading so much. I don't understand why you don't have millions of views. Compared to some other bigger blogs yours is much more real and relatable. Keep up the good work!

Eva

Sunday 21st of August 2022

Hi Supporter, thank you!