I think The American Express Singapore Airlines Business Credit Card has a pretty lengthy name, do you think so? To make our lives easier, let’s just call it AMEX Business Card, or AMEX SIA Business Card, or AMEX HighFlyer. I will use all these names interchangeably throughout this article.

I’ve been a holder of AMEX SIA Business Card since late 2021. To be honest, I’ve been a very satisfied customer from late 2021 to early 2023. This card has become my go-to card for the majority of my spending because of its huge earning rate (1.8 miles per dollar spent), its minimal spending exclusion, and the many offers it has from time to time.

However, they’ve done some adjustments in early 2023 which makes the card a little less… generous. Previously, they have very little spending exclusion, but now the list of exclusion has grown! So, is this card still worth it?

In this article, I’ll share my AMEX HighFlyer Card review from the POV of someone who has been using it since 2021 and is still using it until now.

Table of Contents

What is AMEX SIA Business Card?

AMEX SIA Business Card is a credit card that rewards small businesses with HighFlyer Points when they spend using the card.

On top of that, there are various benefits, such as free Accor Plus membership, Priority Pass access, Hertz Gold status, etc. I’ll dive more into these in “Benefits” section.

The HighFlyer Points can be converted into KrisFlyer Miles (1:1 conversion ratio), however, each individual can only receive a maximum of 30,000 KrisFlyer miles from HighFlyer program per year, and each HighFlyer account can only convert a maximum of 150,000 HF Point to KF Miles in a year. I’ll explain about this more in the “Where to use HighFlyer Points” section.

Companies must enroll into Singapore Airline’s HighFlyer Program, which is a free corporate program for businesses. If your company is not in HighFlyer Program yet, a new HighFlyer account will be created for you when your card is approved.

Requirements

Here are the requirements:

- Age: 21 or older

- Min. income: S$30,000 (Singaporean/PR) or S$60,000 (Foreigner) a year

- Must be a business owner and/or person with executive authority of a Company/Business with a valid UEN

- Documents required:

- A copy of your NRIC/passport

- Proof of residence if different from NRIC

- Last 2 years’ Income Tax Notice of Assessment (not Form B)

- Director’s or Board Resolution, except Sole-Proprietorships and Partnerships

- Certified NRIC/Passport of owners/shareholders, and Proof of residence if different from NRIC

Do note that the income requirement refers to the income of the individual applicant, not the business. So, if your business is earning less than S$30,000, but you have a day job and your total income is more than S$30,000, then you’re eligible to apply.

Business refers to Sole-Proprietorships, Partnerships and Private Limited. There is no income requirement for the business itself.

Annual Fee

When I signed up in 2021, the annual fee was waived for the first year. However, nowadays, the annual fee payment is compulsory if you want to get the welcome bonus.

As of 2023, the Annual Fee is S$301.79/year (inclusive of 8% GST). Supplementary card’s annual fee is S$99.93/card per year (inclusive of 9% GST).

From 2024 onwards, the Annual Fee is S$304.59/year (inclusive of 9% GST). Supplementary card’s annual fee is S$100.85/card per year (inclusive of 9% GST).

When I reached the end of my first year membership in Nov 2022, I was charged with the annual fee. I called to request for waiver but it was rejected without any counter offer.

I called again and talked to another officer; my waiver request was rejected again but this time, I was offered bonus miles. For reference, my first-year spending with HighFlyer card was over SGD 20k. Your experience may vary.

When I reached the end of my second year membership in Nov 2023, I was charged with the annual fee. My second year spending was close to SGD 30k. I called to request for waiver and it was approved. Again, the fee waiver policy depends on many factors so your experience may not be similar to mine.

Welcome Bonus for New Sign-Ups

If you sign up between 1 November 2023 – 28 February 2024 and approved before 30 April 2024, you will get either 68,000 HighFlyer Points OR 10,800 HighFlyer Points + Samsonite Luggage. Here’s the details:

- Welcome Bonus Option 1: Get 68,000 HighFlyer Points (57,200 HF Points welcome bonus + 10,800 HF points based on 1.8mpd on S$6k spending) when you spend S$6,000 in the first 3 months AND pay the annual fee

- Welcome Bonus Option 2: Get Samsonite Choca Spinner 68/25 (worth S$700) PLUS 10,800 HighFlyer Points (based on 1.8mpd on S$6k spending) when you spend S$6,000 in the first 3 months AND pay the annual fee

Do note that the above offer is valid for new sign-ups (not new customers to Amex). So, it doesn’t matter if you already have other Amex cards, you will still get these welcome bonus. BUT, you must not have cancelled Amex HighFlyer previously with the same company.

On top of those, you will also get the additional benefits as follow:

- 5,000 HighFlyer points when you spend S$500 within the first 12 months AND 15,000 HighFlyer points when you spend S$10,000 annually with Singapore Airlines Group

- Complimentary Accor Plus membership worth S$418 (comes with a free night’s stay)

Benefits of AMEX Highflyer Card

Benefit #1: Lounge Access

AMEX Business Credit Card holders are entitled to 2 complimentary visits to airport lounges worldwide (via the Priority Pass network) per membership year.

To enjoy the free airport lounge access, you need to enroll here. Upon submission, you will have to wait about 1-3 business days (but can take up to 15 business days) for approval. Priority Pass will email you directly once your enrollment is completed. For me, I received approval email in minutes after I submitted my enrollment.

Upon successful registration, you’ll have a digital membership card in your Priority Pass mobile app. When you visit a lounge, simply present your PP digital membership card in the app together with your AMEX SIA Business Card, as well as your boarding pass.

Do note that the free 2 visits entitlement is per membership year. It starts from the day you activate your Priority Pass. If you’ve used up your free 2 visits but you want to visit another lounge in PP network, your next visit will be charged at the prevailing rate (currently it’s USD 32 per person per visit).

Benefit #2: High Earning Rate

Amex HighFlyer card has one of the best earning rate compared to other miles credit cards. You can earn up to 8.5 HighFlyer points per S$1 spent on eligible Singapore Airlines Group flights. And you will also earn 1.8 HighFlyer points per S$1 spent on all other spending.

For comparison, other cards only give between 1.1 to 1.4 miles per dollar for general spending, that means AMEX HighFlyer is giving 40%-60% more miles compared to other cards. This explains why I’ve been using AMEX HighFlyer for most of my general spending.

Furthermore, AMEX HighFlyer is really generous, whereby they give points even for transactions that are excluded by many other credit cards, such as Grab top-ups, insurance, utilities, telcos, and government transactions.

Now, AMEX HighFlyer no longer gives points for GrabPay top-up, insurance, utilities, hospitals and government transactions. Telco still earn points.

IMPORTANT NOTES regarding earning 8.5 HF points on SIA flights:

- If you’re booking SQ flights, you need to book the flight by logging in to your HighFlyer Account on SIA website. I made the mistake of logging in to my personal KrisFlyer account when booking my flight and I never received the 8.5 HF Points.

- If you’re booking Scoot flights, you need to book the flight by logging in a dedicated Scoot platform for HighFlyer Account

- Basically 8.5 HF points are made up of 2.5 HF points from Amex card spending + up to 6 HF points from SIA. HighFlyer program itself has 4 tiers: HighFlyer, HighFlyer Silver, HighFlyer Gold, HighFlyer Platinum. HighFlyer & HighFlyer Silver will earn 5 HF points from SIA, while Gold & Platinum will earn 6 HF points from SIA.

- Not all flights and booking ticket classes are eligible for HF points from SIA. For full details on which booking gets HF points, refer to SIA Terms & Conditions for HighFlyer and scroll down to “Earning HighFlyer Points” section. Most promotional fares usually will not earn HF points. In case your flight isn’t eligible to get HF points from SIA, you can still get 2.5 HF points from Amex.

Benefit #3: Free Accor Plus Membership (worth S$418)

This is the one benefit that I treasure the most from the Amex HighFlyer card. Each cardholder is entitled to a free Accor Plus Membership.

With this membership, you can get a free 1-night stay (called Stay Plus) at a participating hotel, dining discount (up to 50%) at various participating restaurants located in Accor Hotels, 10% off the best available rate for hotel rooms including 10% off sales and promotional rates, and occasional room sales.

This membership alone can more than cover the cost of annual fee.

For the dining discount, I’ve used it once at Ellenborough Market Café (read my review here) where I got 50% discount when dining with my hubby on the eve of Public Holiday. There’s no cap on how many times you can use the discount, basically you can use it as frequently as you want, you just need to make booking and tell them that you’re Accor Plus member.

For the free hotel stay, I used it to stay at Swissotel The Stamford (the tallest hotel in Singapore) and Fairmont Beijing. You can use the Stay Plus in any country, not just Singapore.

Benefit #4: Acceleration to KrisFlyer Elite Gold status

If you’re a frequent flyer with SIA, you’re definitely familiar with the Elite status. As a holder of AMEX Highflyer card, you can fast-track to KrisFlyer Elite Gold status by spending S$15,000 with Singapore Airlines Group within the first 12 months. Do note that the status will be valid for 1 year only, subsequently you need to earn 50,000 Elite miles to requalify for Elite Gold status.

If you’re not familiar with Elite status, here’s a brief explanation. You earn Elite miles based on the distance you flew. So, you can’t earn Elite miles by transferring your credit card point. You have to fly to earn it. In the normal scenario, you need to earn 50,000 Elite miles within 12 months to get Elite Gold status. But, this card allows you to get Elite Gold by just spending S$15,000 with SIA Group.

Here are the benefits of KrisFlyer Elite Gold status:

- Regardless of what class you’re flying, if you’re flying with SIA, you and a guest will get access to KrisFlyer Gold Lounge at Singapore Changi Airport and SilverKris Lounges worldwide. If you’re flying with Star Alliance airline, you and a guest will get access to Star Alliance Gold lounges worldwide, regardless of your flight class.

- Priority airport check-in

- Extra baggage allowance

- Gold Track (Priority Security & Immigration)

- And many more (see complete privileges here)

For me, I would definitely love to get Elite Gold status, but unfortunately, I’m not a high spender, so I can’t qualify for Elite Gold status in my first year via this route.

Benefit #5: Hertz Gold Status

As an Amex HighFlyer card holder, you’ll get Hertz Gold Status immediately without having to spend any amount. You need to enroll here.

Privileges of Hertz Gold Status include 10% off best available retail rates, one-car-class upgrade for rentals of 5+ days (subject to availability) and fee-waived additional driver.

Benefit #6: Complimentary Travel Insurance

You’ll get a complimentary travel insurance if you charge the full fare of your round-trip flight ticket to Amex SIA Business Card, or if you use HighFlyer Points to pay for the flight ticket.

This insurance is underwritten by Chubb Insurance and covers baggage delay, baggage lost, flight delay, loss/damage to Personal Belongings, travel accident which leads to accidental death or total disablement, and trip cancellation/postponement. Full T&Cs here.

Benefit #7: Free Conversion from HighFlyer Points to KrisFlyer Miles

Because AMEX HighFlyer is a co-branded card, cardholders enjoy the benefit of free conversion from HighFlyer Points to KrisFlyer Miles. You can perform the conversion any time, as often as you want, without any fee.

The minimum conversion block is 1,000 miles. Read the next section for more details about how to convert HF Points to KF miles.

Where to use HighFlyer Points

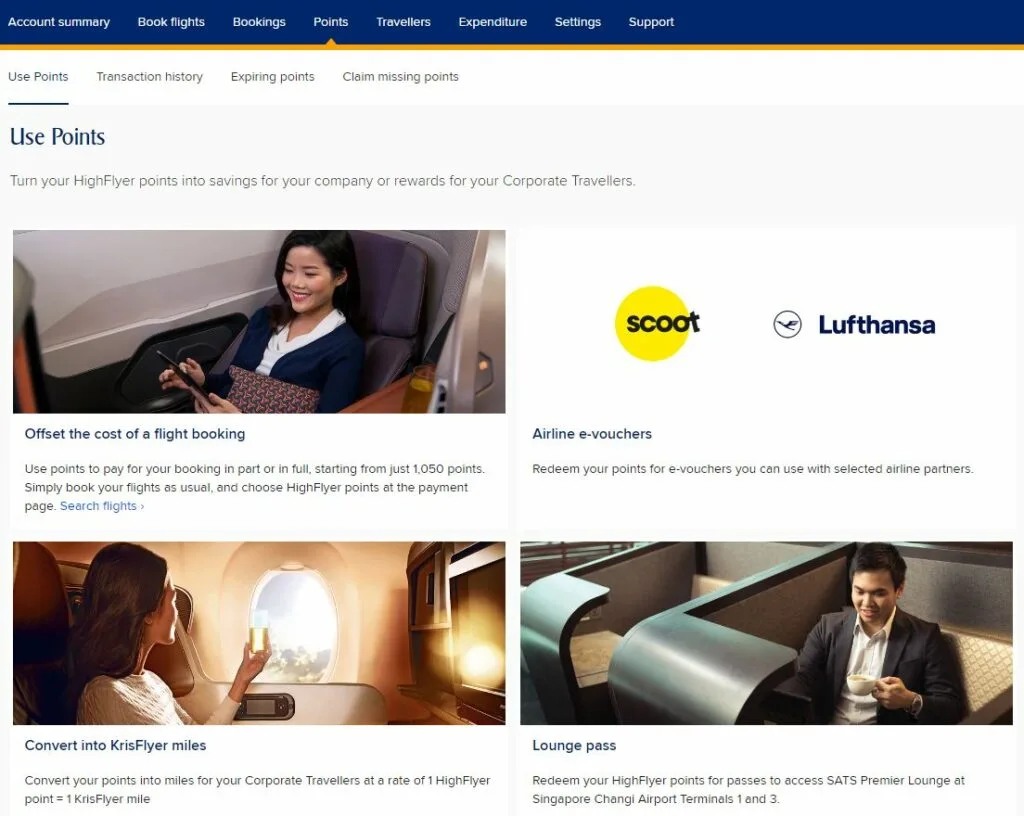

To see where you can use HighFlyer Points, simply login to your SIA corporate account and go to Points Tab, then Use Points. Here is the screenshot of how it looks like.

1. Transfer HighFlyer Points to KrisFlyer Miles

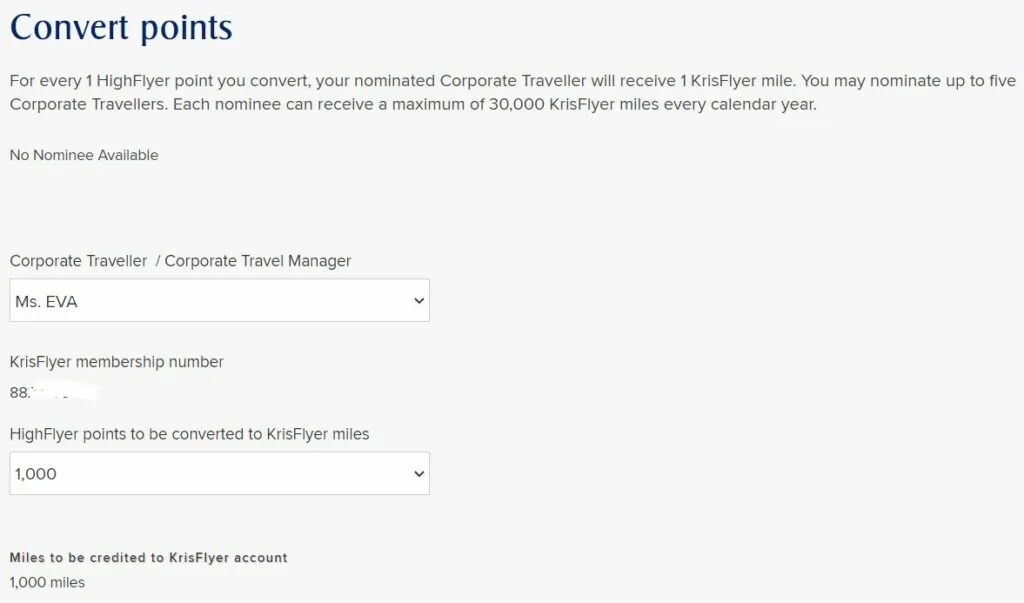

1 HighFlyer Point is equal to 1 KrisFlyer Mile. Minimum redemption is 1,000 HighFlyer Points per conversion. There’s no fee involved in converting HighFlyer Points to KrisFlyer Miles, so you can transfer as frequently as you like. The best thing is, the transfer happens immediately!

BUT, here are some important points to note:

- Each HighFlyer account shall only be linked to a maximum of 5 selected KrisFlyer Accounts for conversion of HighFlyer points to KrisFlyer miles

- Each Selected KrisFlyer Account shall only receive a maximum of 30,000 KrisFlyer miles converted from HighFlyer points per calendar year, amounting to 150,000 KrisFlyer miles for each HighFlyer account

- HighFlyer points are valid for 3 years. So, if you’ve maxed out the 30k cap for the year, the remaining HF points can be carried forward as long as they’re still within 3-yr validity period. But, if you have too much HF points and you can’t transfer them out to KF account in time, you’ll have to redeem HF points for things other than KF miles; otherwise, it’ll expire worthless.

To convert HighFlyer Points to KrisFlyer Miles, login to your Business account on Singapore Airlines’ website. Go to Points > Use Points > Convert into KrisFlyer Miles. Then, choose the traveller account that you want to transfer to, and how many points you want to transfer.

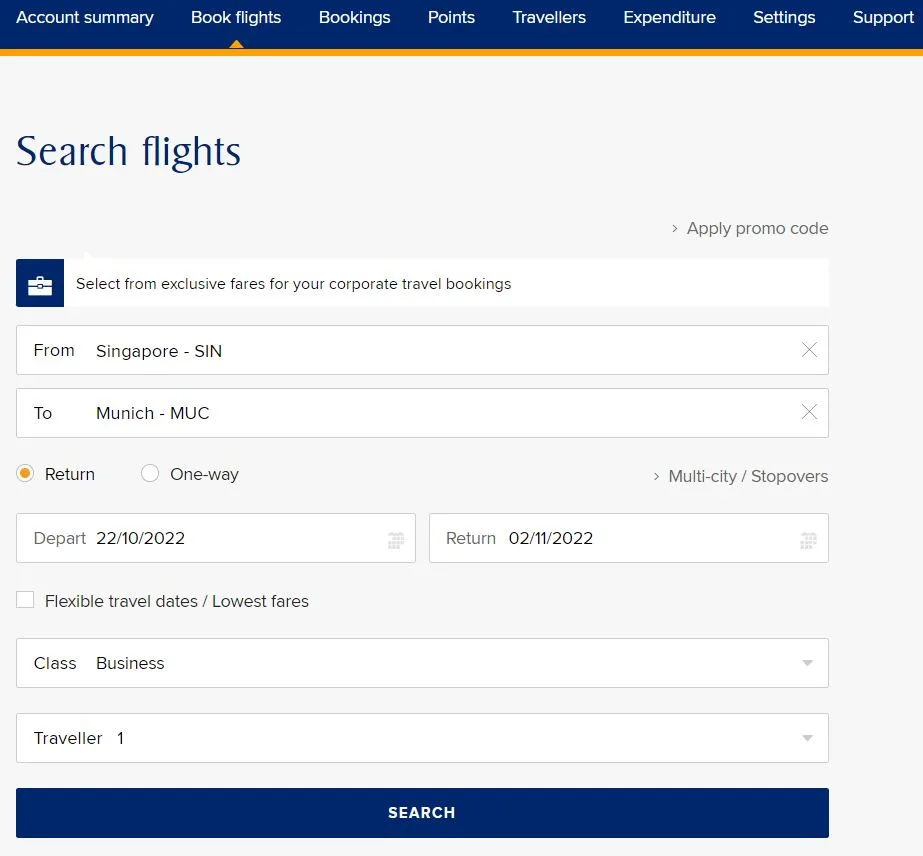

2. Use HighFlyer Points to offset flight tickets

1,050 HighFlyer Points can be used to offsets S$10 from the cost of your flight ticket. That means, each HF Point is worth $10/1050 = $0.0095 per point = 0.95 cents per point.

The minimum redemption of HF points to offset the cost of flight is 1,050 HF points, with subsequent increment of 105 HF Points per S$1.

If you value 1 KrisFlyer mile as 2 cents per mile, then you might want to steer away from using HF Point to offset flight tickets, unless you have too many HF Points and you’ve already maxed out your individual conversion entitlement of 30,000 points transfer per year.

To use HighFlyer Points to offset flight tickets, login to your Business account on Singapore Airlines’ website. Go to Points > Use Points > Offset the cost of a flight booking. Alternatively, you can directly go to Book Flights tab. Then, search for the flights that you want to book, fill up your details and determine how much HighFlyer Points that you want to use.

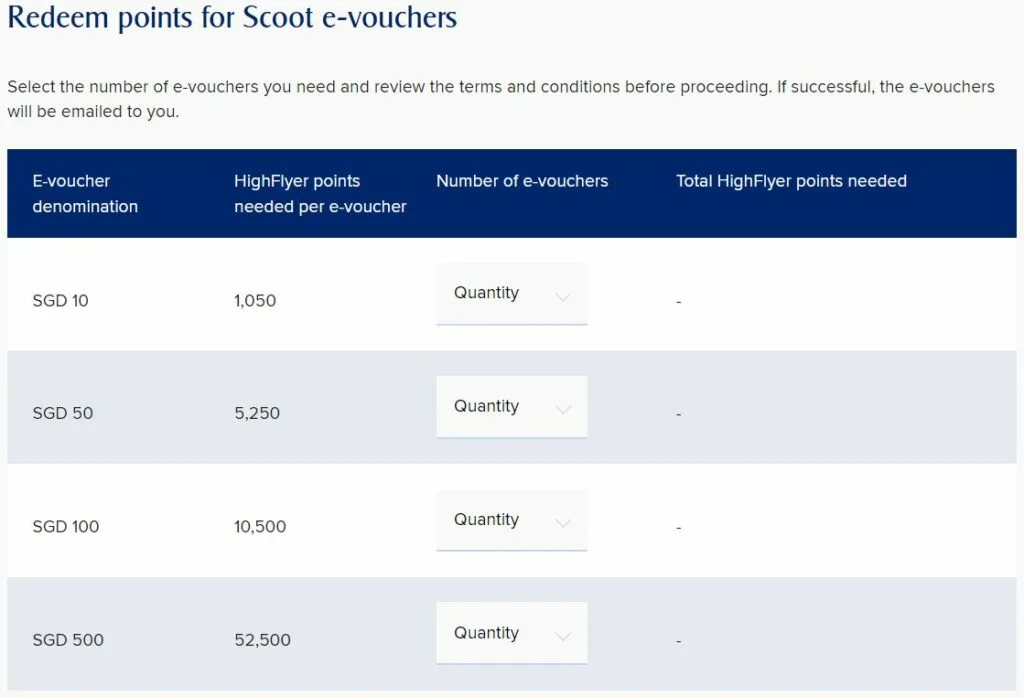

3. Convert HighFlyer Points to Scoot e-Vouchers

Similar to Point #2 above, 1,050 HighFlyer Points can be converted to S$10 Scoot e-Vouchers. That means, each HF Point is worth 0.95 cents per point.

There are 4 denomination of vouchers you can choose from: S$10, S$50, S$100 and S$500. To convert HighFlyer Points to Scoot e-Vouchers, login to your Business account on Singapore Airlines’ website. Go to Points > Use Points > Airline e-vouchers. In the ‘Select Airline’ field, choose Scoot and click Next. Lastly, choose the voucher denomination and quantity that you want.

In the past, you could redeem 5,500 HighFlyer Points for S$50 Lufthansa and SWISS Vouchers. However, that offer is no longer available.

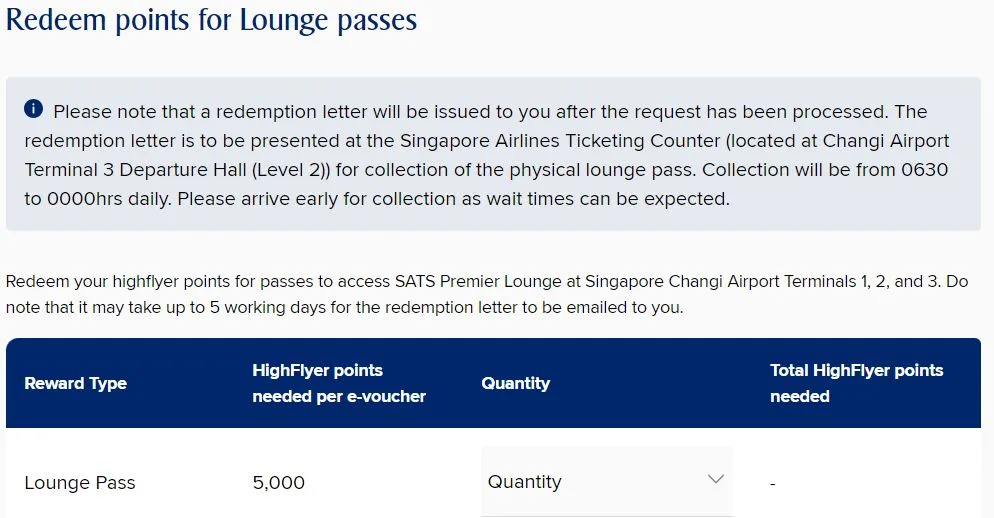

4. Use HighFlyer Points to redeem Lounge Passes

5,000 HighFlyer Points can be converted to 1 Lounge Pass. Each lounge pass allows a traveller to access SATS Premier Lounge Terminal 1, SATS Premier Lounge Terminal 2 and SATS Premier Lounge Terminal 3 at Singapore Changi Airport

To redeem Lounge Pass, login to your Business account on Singapore Airlines’ website. Go to Points > Use Points > Lounge Pass. Choose the quantity of pass that you want. Upon submission, it will take up to 5 working days for the lounge pass to be emailed to you.

On the day of your flight, you need to present this letter at the Singapore Airlines Ticketing Counter located at Changi Airport Terminal 3 Departure Hall (Level 2) for collection of the physical lounge pass. Collection will be from 0630 to 0000hrs daily. Please arrive early for collection as wait times can be expected.

If you ask me whether this is worth it, I would say nope, unless you have too many HighFlyer Points and you don’t know where to use it.

See, 5,000 HighFlyer Points is equivalent to S$47.5 (using the conversion rate similar to using HF Points to offset flight cost). Meanwhile, a paid visit with Priority Pass is charged at US$32 (about S$45 at the time of writing).

By the way, your AMEX HighFlyer card comes with 2 free Priority Pass lounge access per year. If you have fully utilized this, simply charge extra visit to Priority Pass rather than converting HF Point to lounge pass.

For me, the main reason I accumulate HighFlyer Points is to convert them to KrisFlyer miles. The other options are just not worth it in my circumstances.

Spending Exclusion

You won’t earn HighFlyer Points for the following spending:

- a) Charges processed and billed prior to the Enrolment Date or charges prepaid on any Card Account prior to the first billing statement for that Card Account following the Enrolment Date. In other words, you need to be enrolled into HighFlyer programme first before your spending earns you HighFlyer Points (I didn’t have any issue with this because my HF Account was approved at the same time as my Amex HighFlyer card).

- b) Cash Advance and other cash services.

- c) Finance charges – including Line of Credit charges and Credit Card interest charges.

- d) Late payment and collection charges.

- e) Tax refunds from overseas purchases.

- f) Balance Transfer.

- g) Instalment plans, except where American Express determines otherwise.

- h) Annual membership fees.

- i) Amount billed for purchase of HighFlyer Points to top-up your points balance.

- j) Purchase and top-up charges for EZ-Link cards using American Express Cards.

- k) Bill payments and all transactions via SingPost (e.g. SAM kiosks, mobile app, online portal) (with effect from 4 April 2023);

- l) Payments to insurance companies (except payments made for insurance products purchased through American Express authorized channel) (with effect from 4 April 2023);

- m) Payments to Singapore Petroleum Company Limited (SPC) service stations (with effect from 4 April 2023);

- n) Payments for the purpose of GrabPay top-ups (with effect from 4 April 2023);

- o) Payments to utilities merchants (with effect from 4 April 2023);

- p) Payments to public/restructured hospitals, polyclinics and other public/restructured healthcare institutions and facilities (with effect from 4 April 2023);

- q) Transactions relating to education and other non-profit purposes (including charitable donations) (with effect from 1 October 2023)

- r) Charges at merchants or establishments that are excluded by American Express at its sole discretion and notified by American Express to you from time to time

How to Check How Many HighFlyer Points Earned in Each Transaction

There are 2 ways to check how many HF Points earned in each transaction. The first one is via desktop browser, and the second one is via mobile app.

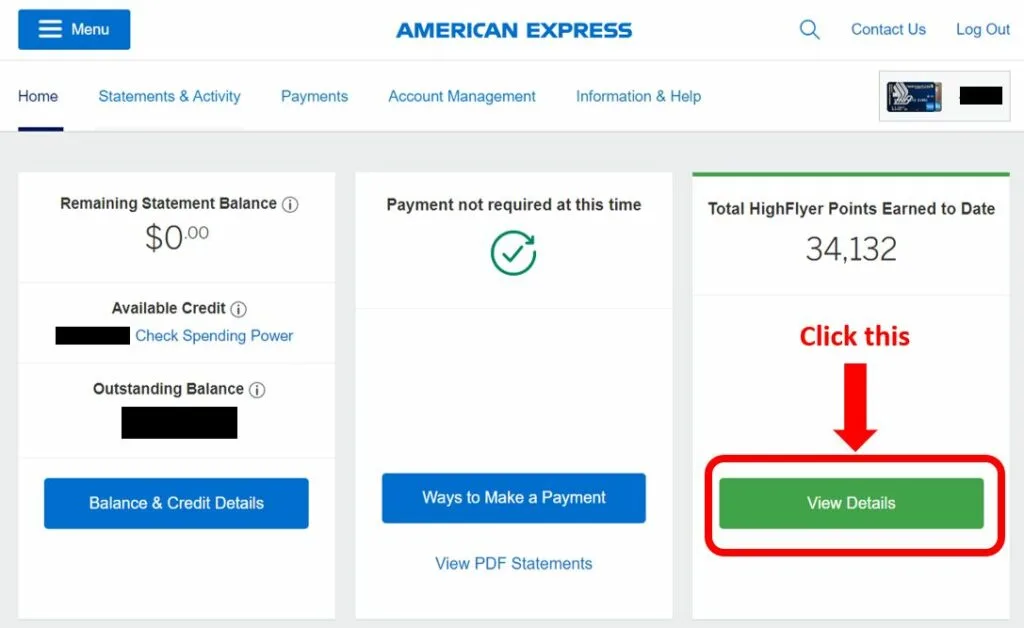

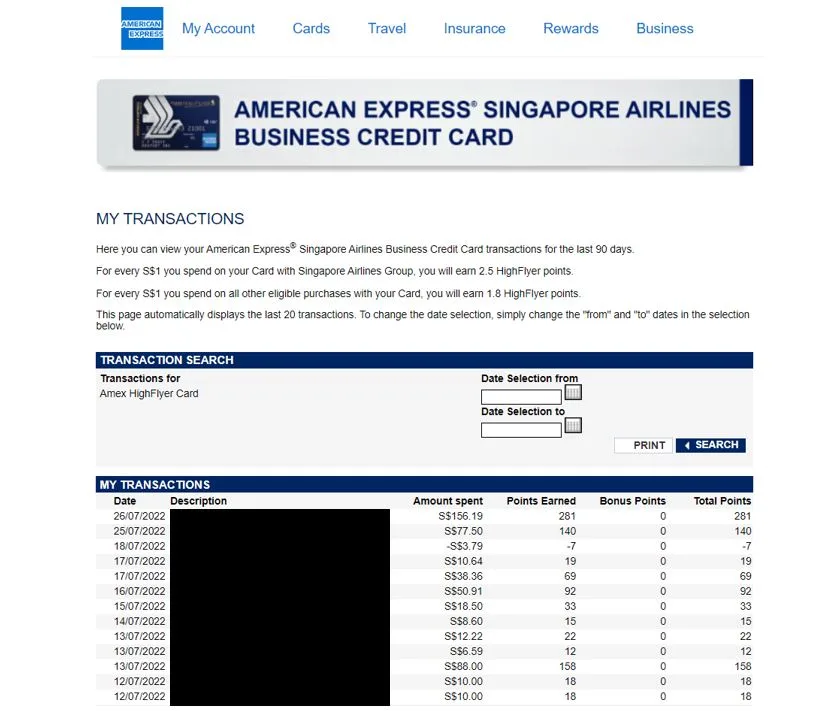

Method 1: Via Desktop Browser

This is my preferred method because you can see transactions up to 3 months prior when you check via desktop browser.

Here’s the procedure: Visit Amex website and login to your account. On your homepage, under “Total HighFlyer Points Earned to Date”, click on View Details button. You will then be directed to a page that shows all your recent transactions in the past 3 months, the number of points you earned on each transaction, as well as bonus points if any.

PS: As of Feb 2023, I can’t seem to check miles earned in each transaction via desktop browser anymore. Not sure if it’s a temporary glitch or permanent restriction.

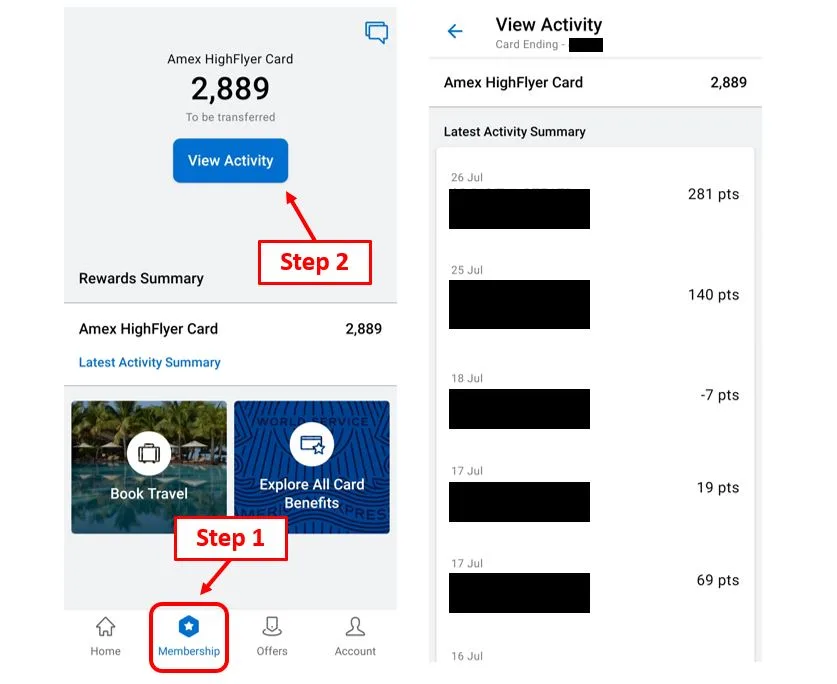

Method 2: Via Mobile App

This method allowed you to see a very limited number of transactions (about 25 latest transactions). And you won’t be able to see the breakdown of basic points and bonus points.

Here’s the procedure: Open your Amex SG mobile app, select AMEX HighFlyer Card, tap the Membership tab at the bottom of the screen. Then, tap View Activity button. You will then be able to see your recent transactions and the number of points earned on each transaction.

What I Love about AMEX HighFlyer Card

- I really love having a free Accor Plus membership which comes with 1 free night say and dining discounts.

- I also love that it has one of the best miles earning rate (1.8mpd for all spending) in the 30K income category.

I absolutely love that the spending exclusion is very minimal, unlike other consumer cards in the 30K income category.- Free 2 lounge access from Priority Pass. This will come in handy if I fly economy class.

What I Don’t Like about AMEX HighFlyer Card

- Each individual can only receive 30,000 KrisFlyer Miles that’s converted from HighFlyer Points per year. Too bad this good stuff has a cap.

- Once in a while, the SIA KrisFlyer portal gets buggy and I can’t login even though I’ve typed in the correct username and password. I can’t imagine how I feel if I have to buy a ticket urgently but can’t login to the portal and have go through the troublesome way of booking a flight via SIA ticket office, call center, or via travel agents.

- Many exclusions, including Grab top-ups, insurance, utilities, hospital, education, donations, and government transactions.

Conclusion

AMEX SIA Business Card is a solid card for miles chaser who’s also an SME owner. It has one of the highest earning rate on general spending (1.8mpd for general spending is very rare in Singapore).

If you love the card but you don’t have a company, maybe it’s time to start exploring if you have any hobby that you can turn into a side hustle.

If you’re an SME owner but you’re not a miles chaser, and you love the idea of a free hotel stay. I think you’d love this card.

Resources

If you like my work, you can buy me a coffee! Your support will help me to keep going!

Reeze

Sunday 18th of February 2024

Hi Eva, I'm thinking to get this card but my main concern is if I can use the HF points to redeem for upgrade to biz class? Like now I can buy an ecomony ticket and use KF miles to upgrade to biz class.

If I DO NOT transfer/convert HF to KF personal miles, can i use HF points directly to upgrade to biz class? Thanks!

Eva

Monday 19th of February 2024

Hi Reeze, you can use HF points to redeem/upgrade to biz class, but it will be treated as a cash rebate (1,050 HighFlyer Points = S$10), not as miles. For example, if the redemption/upgrade costs S$1000, you will be using up 105,500 HF points. To me, it’s a poor use of HF points because in this scenario, each HF point is worth only 0.95 cents per point, whereas if you transfer to your personal KrisFlyer account and use it for business class redemption, each KF mile is worth at least 1.5 cents.

John

Monday 15th of January 2024

Would you recommend getting this card solely for booking scoot flights? Do the rates on the scoot highflyer portal and the normal scoot website differ a lot?

Eva

Tuesday 16th of January 2024

I think it depends on how often you fly with Scoot, and which booking class you choose. Do note that V or K booking classes do not qualify for HF points, while Q or N booking classes only qualify for 50% HF points. If you fly a substantial amount of flight with Scoots, I think this is a good card to get. Personally, Scoot wasn't my main consideration when I applied for this card, I was more drawn by the Accor Plus membership, as well as 1.8mpd for general spending.